MOD EXPERIENCE

A quick guide to understanding the NCCI Mod Rating worksheets.

Experience Modification Rating (EMR) in a Nutshell:

The EMR is a number used to adjust insurance premiums, based on a company’s past workplace injury claims.

The Experience Modification Worksheet:

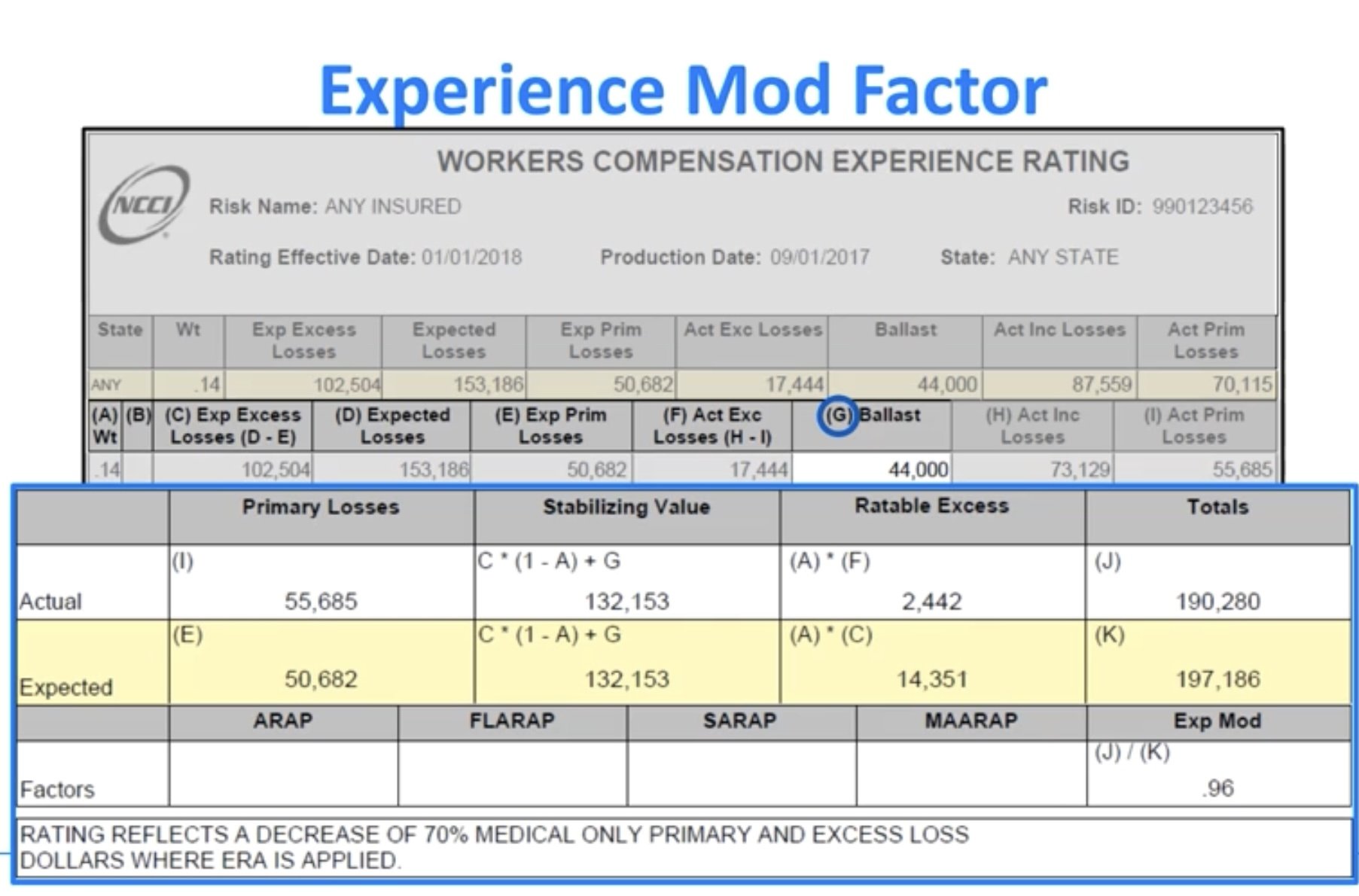

The NCCI Experience Modification Worksheet is a tool used by the National Council on Compensation Insurance (NCCI) to calculate an experience modification factor (EMF) for workers' compensation insurance premiums. The EMF reflects a business's claims history compared to other businesses in the same industry. It considers factors such as the frequency and severity of workplace injuries and illnesses. A lower EMF generally indicates better safety practices and can lead to lower insurance premiums, while a higher EMF may result in higher premiums.

What's in the Worksheet:

Basic Info: Company details like name, address, and policy number.

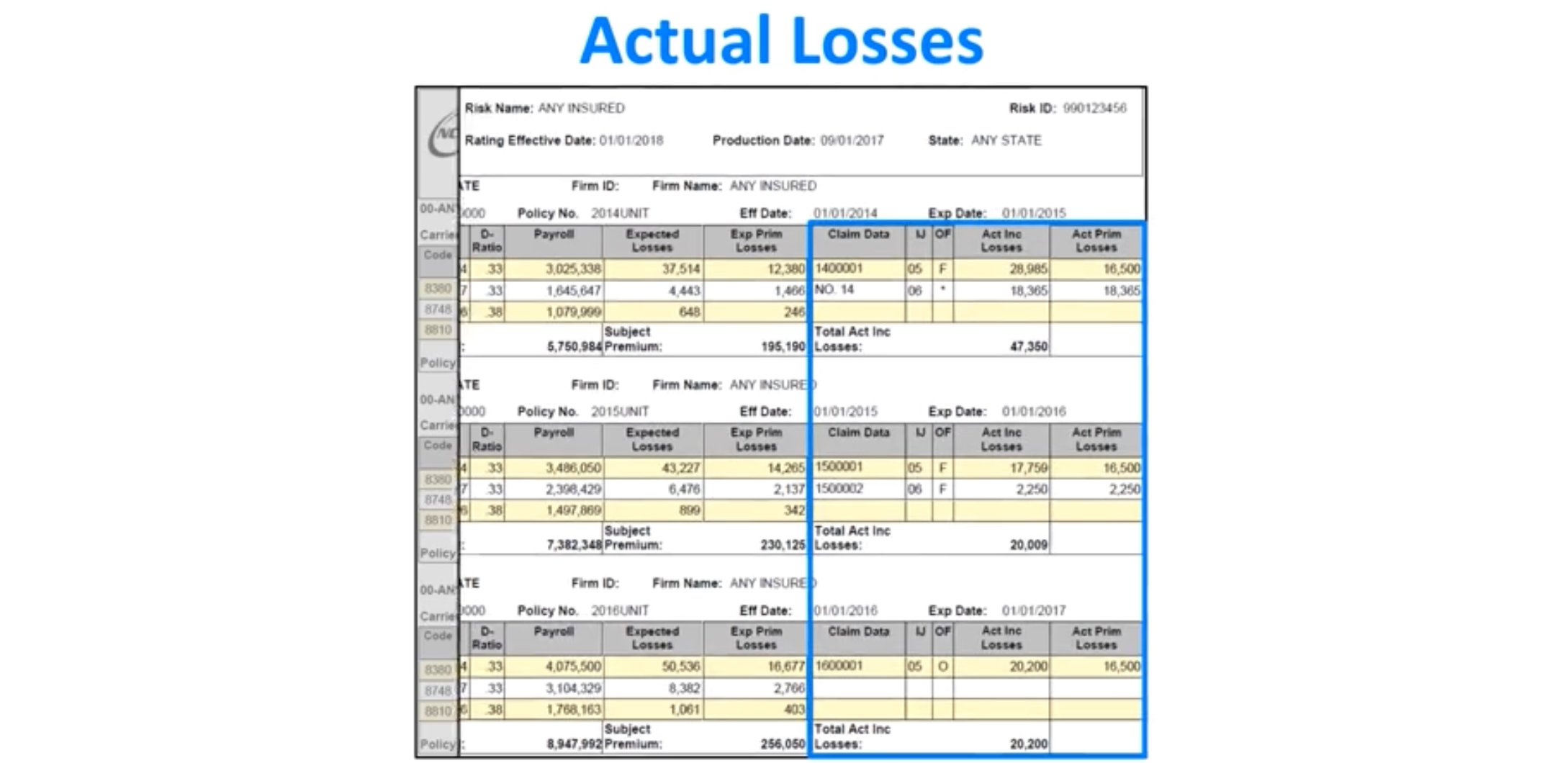

Policy Period: The timeframe for calculating the EMR, usually spanning three years.

Claims Data: Details of each workers’ comp claim, including date, type, and amount paid.

Expected Losses: Predicted losses based on industry standards.

Calculating Expected Losses Formula

Expected Losses = Payroll Divided by 100 x ELR column

EMR Calculation: Formula comparing actual losses to expected losses.

Impact on Premium: EMR affects how much a company pays for insurance.

Using the Worksheet:

Know Your Numbers: Understand your claims history and EMR to manage costs.

Spotting Errors: Check for inaccuracies that could affect your EMR and premiums.

Appeal if Needed: If you think there's a mistake, there's a process for disputing it.

NCCI Mord Worksheet Correction:

To apply for a correction to the NCCI Experience Modification Worksheet, a company typically needs to follow these steps:

Review the Worksheet: First, review the NCCI Experience Modification Worksheet provided by your insurance carrier or obtained directly from NCCI. Identify any discrepancies or errors in the data used to calculate your experience modification factor (EMF).

Gather Documentation: Collect all relevant documentation that supports your claim for correction. This might include payroll records, claim information, and any other relevant documents that demonstrate inaccuracies in the data used for the calculation.

Contact your Insurance Carrier: Reach out to your insurance carrier or agent to discuss the discrepancies you've identified and express your intention to apply for a correction to the EMF. Provide them with the documentation supporting your claim.

Submit a Request to NCCI: If your insurance carrier agrees that there are errors in the calculation, they may submit a request for correction to NCCI on your behalf. Alternatively, you may be required to submit the request directly to NCCI, depending on your specific circumstances.

Follow Up: Keep in touch with your insurance carrier and NCCI to monitor the progress of your request for correction. Be prepared to provide any additional information or documentation requested during the review process.

Review the Updated Worksheet: Once NCCI processes your request, review the updated Experience Modification Worksheet to ensure that the corrections have been made accurately.

Why It's Important:

Understanding your EMR and worksheet helps manage costs and promote workplace safety.

In a nutshell, mastering your EMR and the worksheet can lead to safer workplaces and better insurance rates for your business.